On the 30th of November two reports have been released in Brussels related to European defence: EDA 2022 data on the occasion of the Agency annual conference, and 2023 Facts & Figures by the ASD European Industrial Association. The first provides the measure of Member States’ eight-year continued commitment referred to 2022 with some mixed results, the second the positive state of play of the European Aerospace and Defence industry.

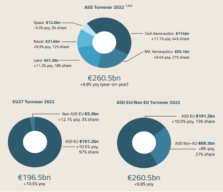

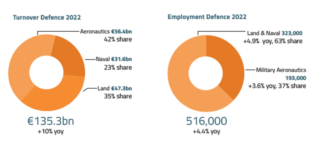

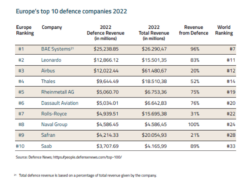

A first snapshot is provided by the ASD report with these two graphics regarding the most important European defence conglomerates and their combined economic impact.

THE DATA OF EDA

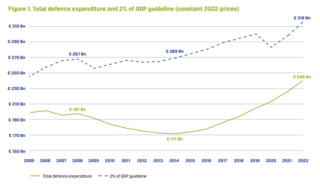

In a nutshell, EDA constant figures show positive results such as EU27 (including Denmark but without UK) defence investments significantly increased by 7% YOY (year-on-year) at € 58 Bn, of which 58,5 procurement and 9,5 R&D (Research and Development).

Overall, EU27 total defence expenditure reached € 240 Bn, a figure still € 76 Bn short of 2% NATO target corresponding to € 316 Bn in 2022. Defence spending remains stable at 1,5% of GDP.

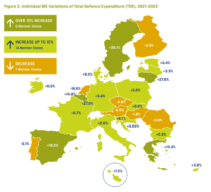

Twenty Member States surpassed the agreed benchmark of investing 20% of their defence budgets, resulting in an overall average of 24%, driven by France and several Eastern countries. The graphic below shows trends of growth expenditure by Nation.

However, critical issues were confirmed such as a reduction of R&T (Research and Technology) by € 200 Million to € 3,5 Bn last year, while minus € 8 Million in collaborative R&T was not significant.

EDA argued that for the first time all EU27 provided data, but that these are still incomplete since just nine Member States delivered information on collaborative European defence equipment procurement.

Since this picture provides information related to the year 2022, it cannot include the significant developments occurred in 2023 such as the unprecedented increase of defence investments in some major countries as well as in others. It is commonly assumed that a continuous growth is going to reach a level of €100Bn within Europe at large, including EU, UK, Turkey and Norway.

EDA’S ANNUAL CONFERENCE

At the EDA conference, the EU Council President Charles Michel confirmed the need of joint procurement and programmes, and considered the idea of European defence bonds to strengthen the technological and industrial base and its value chain, which could emerge as a new asset class, including retail investors.

HR/VP Josep Borrell took stock of this EDA report, with a focus on challenges and opportunities for Member States. Calls were addressed to Member States in order to increase cooperative investments in next generation technologies, increase the spending in Europe in a coordinated way and reduce dependencies from off-the-shelf acquisitions, define demand and long-term solutions for ammunitions’ production, think bigger for PESCO projects. He also warned that, despite the recent increases, the bloc still faced “key capability gaps” and continues to “lag behind other global players”.

Ursula von der Leyen gave an impressive and strong speech on European Defence, outlining the need to pursue a EU strategic responsibility in defence as strategic competition intensifies as well as a call for more contributions in the defence sector. Detailed references were made on the upcoming EDIS (European Defence Industrial Strategy), focussing on four strands of work, namely:

a strategic planning function to coordinate Member States’ requirements;

more efficient and simplified rules;

exploitation of the dual-use potential;

mobilisation of public and private funding.

A set of initiatives are on the pipeline, some of them politically sensitive such as considering defence investments as a relevant factor under EU fiscal governance rules as well as financing the EPF (European Peace Facility) through the EU budget in a future MFF, under the current Treaties.

A long list is likely to provide guidelines and orientations to the new EU institutions after the European elections. This includes making better and accelerated use of current tools to be revised, such as:

Chips IPCEI (projects of common interest) to be replicated;

identify flagship capabilities at European level;

updated regulatory framework;

maximize dual-use potential;

transfer EDF R&D results to full industrial products;

an EDIP (European Defence Industry Programme) with adequate funds, addressing the whole cycle of capability development, including industrial implementation and production;

call on the EIB (European Investment Bank) to promote to the European defence industry (which could be likely);

interlinks on security with other EU policies;

VAT exemptions;

ESG recognition of defence.

However, it remains to be seen the Member States’ appetite to take on board all ambitious topics, as some were re-introduced in the list, notwithstanding Nations’ early rejection when negotiating ASAP Regulation, upon concern of EU going beyond its competences.

DEFENCE (INDUSTRIAL) PRIORITIES IN THE BELGIAN PRESIDENCY

Today, the agenda of the Belgian Presidency of the EU Council includes also security in policy domains, with a view of focussing on-going discussions on major topics, such as:

defence industry readiness and support to Ukraine;

implementation of the Economic Security Strategy through an ad-hoc Package, dealing with the revision of the FDI (Foreign Direct Investments) screening regulation and an outbound investment screening mechanism and proposals for de-risking EU trade relations;

implementation of the Strategic Compass on rapid deployment capacity and military mobility as well continuing work on space, cyber and maritime security.

EU AND US INDUSTRY DATA

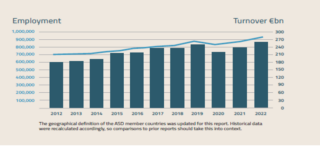

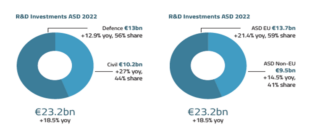

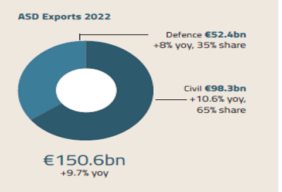

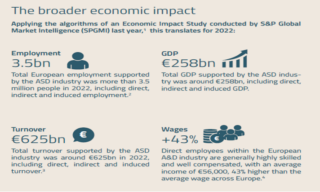

On the supply side the ASD, the European Association for AeroSpace & Defence industries, released its annual Facts & Figures brochure on the state of its sector, the last of a series started in the mid-90s, when it replaced the EC “pink” The European Aerospace Industry – trading position and figures. F&F has been considered as a reliable and unique source that EC largely has been referring to. The comprehensive message highlighted the 2022 ASD civil and military industry ecosystem’s positive features, namely resilience, recovery, innovation, export driven, as well as achievements such as general growth in all sectors, in revenues, employment, export, R&D investments. All data and comments are available in the ASD website www.ASD-Europe.org. All graphics below are have ASD as source.

All European countries in various breakdowns:

Industry civil and military turnover

Total civil and military turnover and employment 10-year trends

Total civil and military Research & Development

Total civil and military export

Defence turnover and employment breakdown

By comparison, in the USA strong achievements were obtained by the aerospace and defence sector in 2022. AIA (Aerospace Industry Association) Facts & Figures reports a workforce reaching 2,2 Million units (+4,8% YOY), with a breakdown of 1,3 million units in the commercial aerospace sector and 940.000 in defence and national security.

Combined revenues climbed up to $952 Bn (+6,7% YOY), exports rose to $105 Bn with a +50% positive trade balance, bolstered by the return to pre-pandemic levels of employment and economic contributions, despite macroeconomic pressures such driving up costs (e.g., inflation and continued supply chain disruptions and delays, labour shortages, etc.). Regarding total sales revenues, 56% was generated through end-use direct production and 44% through indirect output of the broad domestic value chain, spanning among 60.000 companies.

According to SIPRI Top100 arms companies, US total defence sales amounted to $300 Bn, generated 40 companies. In parallel, CRS papers report DoD contract funds in 2022 totalling $424Bn.

Methodological note on statistics. One must take into account that US AIA industry data refer to different perimeters with respect to EU numbers, therefore they are not directly comparable: it is the US ecosystem vs the European aerospace & defence manufacturing sector.

Fabrizio Braghini

Fabrizio Braghini is a European and defence policies analyst. He has worked for decades in Finmeccanica, now Leonardo SpA, the prime Italian defence industrial conglomerate.