What kind of economic prospects for the region?

Karim El Aynaoui, Oumayma Bourhriba

Over the past decade, the demand for economic, social and political change in the region has been steadily growing. The COVID-19 crisis has compounded the existing challenges and unveiled the vulnerabilities from North Africa to the Middle East at different levels (UN, 2020): violence and conflict, inequality, unemployment, poverty, limited social protection, education, poor infrastructure and weak governance.

In order to prevent another lost decade, MENA countries are more than ever called upon to rebuild trust between citizens and the State by reforming the governance and enhancing participatory democracy. Moreover, recovery from COVID-19 pandemic should be considered as a real opportunity to lay the institutional milestones and implement the socio-economic reforms needed to build back resilient, sustainable and inclusive economies.

I – ARAB STATE REFORM: TOWARDS A PARTICIPATORY AND SOCIAL STATE IN THE POST-COVID-19 ERA

The discontent observed in the region over the past decade was broadly triggered by a breakdown in the relationship between State and society. Restoring peace and security in the region begins with rebuilding trust between citizens and states (Aboughazi, A. et al. 2018). In this regard, countries need to ensure the application of good governance practices, promote citizens’ participation in public policy design and implementation via an open social dialogue, and expand access to social services and economic opportunities for all.

The COVID-19 pandemic has highlighted the crucial role of the State in protecting and prioritizing human capital. Indeed, the states of the region need to reform their intervention framework and assume a more effective role at different levels (Bassou, A. et al., 2020): regulators of economic and social life, providers of public services, promoters of social solidarity and national cohesion, defenders of national competitiveness, and strategic partners of other public and private actors.

Social Protection for All

The COVID-19 crisis has further increased the pressing burden of the lack of social protection in the region with limited coverage of social safety nets to protect the most vulnerable. Before the COVID-19 crisis, around 42%1 of MENA’s population lived on incomes below US$5.5 per day, youth unemployment hovers on average around 26%2 and 64% of the region’s wealth is held by the top 10 richest of the population (Alvaredo, F. et al. 2018). Informal employment reaches up to 68% (Florence, B., et al 2019) on average of employment in the region which increase the vulnerability of informal workers to adverse shocks due to a lack of social cushion. The current crisis is threatening an additional 8 million people in the region to fall into extreme poverty and pushing an additional 18 million people into living on less than US$5.5 per day. In addition, expenditure on social protection in the region remains extremely low. According to ILO’s World Social Protection Report 2017-2019, Mashreq and North African countries spent on average 2,5% and 7,6% of GDP, respectively, on social protection (excluding health care).

Social protection reforms are needed now more than ever in the region. Social protection measures have played a major role in mitigating the impact of the crisis in the MENA region ranging from cash transfers, unemployment protection and in-kind support to price subsidies and low-interest loans. According to IMF (REO, April 2021), inequality and poverty are nonetheless expected to rise after the crisis. Governments must therefore enhance their efforts and expand both horizontal and vertical social protection towards a universalist approach. For instance, Morocco has put the social protection of its citizens at the top of its priorities in order to lift fragile segments of the population from vulnerability. On April 14th 2021, HM King Mohammed VI launched the implementation of the social protection generalization reform to all the categories of society. This ambitious project will allow the access of 22 million additional people to mandatory health insurance by 2022, generalizing family allowances by 2024, and expanding retirement pensions and job loss benefits by 2025.

Unleashing the potential of MENA’s youth

MENA’s young population is an untapped potential representing nearly two-third of region’s population. Many of the Arab uprisings were led by educated young protesters frustrated by lack of economic opportunities, poor quality of public services and weak governance institutions (Elena, 2018). This vital segment of the population is characterized by the highest unemployment rate worldwide and 85% of youth work in the informal sector with limited or no access to social and health protection (ESCWA, 2020). The COVID-19 economic slowdown and its consequences in terms of job and income losses, is aggravating these vulnerabilities. Furthermore, the youth and youth organizations have played an overarching role in mitigating the impacts of the crisis and showed tremendous intergenerational solidarity – such as running information campaigns, supporting vulnerable population providing online activities and trainings (OECD, 2020).

The current crisis is an opportunity for MENA governments to restore youth’s trust. Governments need, in this respect, to urgently revise national youth strategies to ensure greater inclusion by establishing reforms ranging from better the quality of education and labor market efficiency to the promotion of a culture of entrepreneurship and improvement of financial conditions. Moreover, they should consider youth participation in addressing the structural challenges of the region in the recovery plans.

II – DEVELOPING MORE RESILIENT, SUSTAINABLE AND INTEGRATED ECONOMIES

The COVID-19 pandemic has exacerbated certain structural economic and social shortcomings of the current development models in the MENA region. Indeed, the overall economic performance of the region was sluggish in the aftermath of the Arab spring and unemployment rate remains the highest worldwide (figures 1&2). This non inclusive slow economic growth is the result of undiversified economies, weak governance, absence of a vibrant private sector and skill mismatches. The current crisis could be the momentum for the MENA countries to recover on a solid basis. Reforms around diversification, green transition and integration will be instrumental in ensuring resilience, sustainability and inclusiveness.

Figure (1): GDP and GDP per capita growth rates, in %

(Average 2000-2011 and 2011-2019)

Source: based on World Development Indicators database (World Bank)

Source: based on World Development Indicators database (World Bank)

Figure (2): Unemployment rate, per region, in %

(Average 2000-2011 and 2011-2019)

Source: based on World Development Indicators database (World Bank)

Source: based on World Development Indicators database (World Bank)

Towards more Diversified Economies

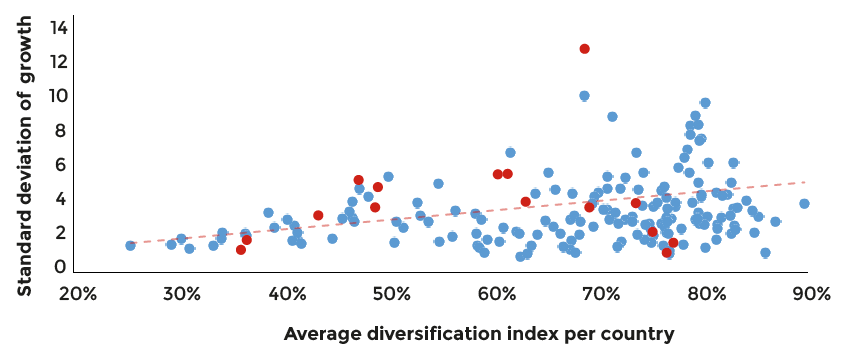

Economic diversification is crucial for sustainable growth and job creation. Concentrated economic structure and trade tend to increase country’s exposure and vulnerability to sector-specific shocks. As figure (3) shows, diversified economies display lower growth volatility. Furthermore, diversification contributes to the emergence of new sectors and the creation of a more dynamic private sector able to absorb the high unemployment of the region. MENA labor markets are characterized by informality, the highest rates of unemployment and the lowest rates of labor participation especially among youth and women. In fact, more than 25% of the youth are unemployed and only 20% of women participate in labor market compared to Sub-Saharan Africa (SSA) for example (12% and 61,3% respectively) (figure 4).

Figure (3): Diversification and growth volatility relationship, across the world*(1995-2018)

“The diversification index is computed by measuring the absolute deviation of the trade structure of a country from world structure. it takes values between 0 and 1. A value closer to 1 indicates greater divergence from the world pattern and thus lower diversification”- Source: UNCTAD.

Source: based on United Nations Conference on Trade and Development database

Figure (4) : Selected Labor Market Indicators per Region (2000, 2019)*

MENA countries are indicated by the red dots.

Source: based on World Development Indicators database (World Bank)

MENA countries’ reliance on natural resources exports and revenues remains a major development impediment. The COVID-19 outbreak emphasis the need to scale-up diversification efforts in MENA region in order to reduce high dependencies on oil (MENA oil exporters), remittances (e.g. Egypt) and tourism (e.g. Jordan, Lebanon and Morocco) (IMF REO, 2021). Two-thirds of MENA region are high and upper-middle income countries, however the average performance of the region in terms of export diversification is low compared to other countries in the same income groups. UNCTAD’s export diversification index amounted in average 72% between 1995 and 2019 in MENA region, 56% in high income countries and 68% in upper-middle income countries. However, there are some different patterns within the region: MENA resource-poor countries are more diversified than resource-rich ones with average Diversification Index amounting 63% in the former and 75% in the latter. United Arab Emirates is a successful exception among resource-rich countries, with an index equals to 59% in average during the period 1995-2019, which is close to Tunisia – the first diversified country in resource-poor countries. Besides the oil sector, UAE focused on developing non-oil sectors such as promoting tourism and restructuring industrial sectors (OECD, 2018).

International experience shows that diversification is achievable but there is no magical recipe that fosters and accelerates diversification process in a systematic way. Over the past few decades, countries such as Mexico, India and Malaysia, managed to successfully diversify their economies even though they encountered similar political and economic difficulties to those in MENA region today (WEF, 2018). In this respect, MENA countries should first focus on implementing fundamental policies that have been established in any diversified economy and that: improve the quality of education; spur innovation; support private sector development; and ensure sound macroeconomic management. Furthermore, additional policies need to be tailored in order to take into account heterogeneity of MENA region in terms of resources and political stability. Overall, the likelihood of success of diversification depends on the specificities of each economy, the timing and sequencing of policy reforms. In other words, in order to achieve the diversification goal, each MENA country should implement specific policies that take into consideration all idiosyncratic characteristics in terms of resource endowments, economic and social structure.

Recovery plans should go hand in hand with the green transition

Many countries around the world have aligned their recovery packages with climate and environmental policies. For example, European Union decided to make the European Green Deal the EU’s recovery strategy “Next Generation EU”. Complying with green norms of production will become an important criterion for access to foreign markets as several European countries have decided to decarbonize their productions as well as imports through the implementation of the carbon tax. Therefore, MENA countries will eventually have to adapt to this transition and need to build back “greener”. For example, Morocco – ranked in top 10 of the Climate Change Performance Index since 2014 – is redesigning the contours of sectoral plans around environmental commitments such as the Green Generation 2020-2030 strategy and the new Industrial Recovery Plan 2021-2023 by capitalizing on its expertise in the renewable energy sector. In this vein, a program has been launched early this year called “Tatwir Green Growth Program” with the aim to support the decarbonization of industrial SMEs and promote the emergence of new competitive green industries. MENA governments should set a green conditionality to their financial stimulus by prioritizing investments that foster environmental goals. For example, the European Recovery Fund, amounting to over €1 trillion for the period 2021-2027, devotes 30% of its budget to green projects.

Strengthening decentralization is key

The COVID-19 outbreak has emphasized the importance of effective decentralization. In fact, in some decentralized countries such as Germany, the flexibility of their interventions and the sustained coordination between the State and the regions facilitated the management of the crisis (Bassou et al. 2020). On the other hand, centralized government structures in the MENA region have struggled to cope with the crisis. Despite the progress recorded in decentralization since the Arab Spring, several MENA countries lack effective application of the reform because of different obstacles such as ambiguous legal framework, financial and human resources, regional disparities in funding (USAID, 2020). In this regard, MENA countries need to rethink the relations between the State and local authorities and shift towards more effective decentralization. In addition, new territorial policies aiming at reducing social and territorial fractures are necessary.

Strong regional and international cooperation is needed to face present and future challenges.

Regional cooperation should support national endeavors in protecting the poor and the most vulnerable against the impact of the pandemic and any future crisis in general. MENA countries need to coordinate their actions and set up a regional social solidarity fund in order to ensure well-targeted and rapid assistance to the poorest, especially in least developed MENA countries. This fund could also aim to support SMEs, notably those that are involved in core economic activities such as health and food. Besides its importance in resolving the structural conflict in the region and protecting human rights, constructive international and regional cooperation would help fight the COVID-19 pandemic and foster socioeconomic recovery through sharing expertise and surplus vaccines, as well as access to financing sources.

Under the current global trade trends, MENA region can seize the opportunities of nearshoring or reshoring arising in GVCs. As uncertainty has been reinforced in the current crisis, in addition to low interest rates, GVCs are becoming more local and regional, opening therefore an opportunity window for their neighbors (World Bank, 2020). In order to potentially benefit from these reconfigurations, MENA countries need to strengthen RVCs and expand trade towards GVCs, particularly in vital sectors such as food security, health systems, renewable energy and digitalization. These ambitious goals require MENA governments to: deepen and expand trade integration within the region, with Europe as well as SSA, accelerate national sectoral reforms; and invest in infrastructure in order to reduce trade costs.

REFERENCES

Aboughazi, A., Bassou, A., Belarbi M., Benkhattab, A., De Vasconcellos, A., El Ouazzani, A., Guennoun, I., Haddy, M., Hajouji, N., Kawakibi, S., Lannon, E., Naimi, M., Rezrazi, M., & Saaf, A. (2018) Mutations Politiques Comparées au Maghreb et au Machrek 7 ans après le Printemps Arabe. Policy Center for the New South.

Alvaredo, F., Assouad, L., & Piketty, T. (2018) “Measuring Inequality in the Middle East 1990-2016: The World’s Most Unequal Region?”. Review of Income and Wealth, 65(4), pp. 684-711.

Bassou, A., Boucetta, A., Chegraoui, K., Chekrouni, N., Drissi Daoudi, Y., Driyef, M., El Aynaoui, K., El Houdaigi, R., El Ouassif, A., Jaidi, L., Loulichki, M., Rezrazi, M., & Saaf, A. (2020) L’Etat Révélateur de la COVID-19. Policy Center for the New South. Policy Paper 20-17.

ESCWA (2020). Impact of Covid-19 on Young People on the Arab Region. United Nations. Policy brief.

Florence, B., Vanek, J., & Chen, M. (2019) Women and Men in the Informal Economy – A Statistical Brief. Manchester, UK: WEIGO.

Ianchovichina, E. (2018) Eruptions of Popular Anger: The Economics of the Arab Spring and Its Aftermath. MENA Development Report. Washington, DC: World Bank.

International Monetary Fund Regional economic outlook. Middle East and Central Asia. World Economic and Financial Surveys. Washington, DC. April 2021.

OECD (2020) Youth and COVID-19: Response, recovery and resilience, https://read.oecd-ilibrary.org/view/?ref=134_134356-ud5kox3g26&title=Youth-and-COVID-19-Response-Recovery-and-Resilience

OECD (2018) Trends in trade and investment policies in the MENA region https://www.oecd.org/mena/competitiveness/WGTI2018-Trends-Trade-Investment-Policies-MENA-Nasser-Saidi.pdf

United Nations (2020) The Impact of COVID-19 on the Arab Region: an Opportunity to Build Back Better. Policy Brief.

USAID (2020) Comparative Analysis of MENA Subnational Governance Governance Integration for Stabilization and Resilience in the Middle East and North Africa. https://pdf.usaid.gov/pdf_docs/PA00X83Z.pdf

World Economic Forum (2018) Arab World Competitiveness Report 2018. Geneva.

Karim El Aynaoui

Executive President of the Policy Center for the New South, and Dean of the Faculty of Economics and Social Sciences and Executive Vice-President of the Mohammed VI Polytechnic University. From 2005 to 2012, he worked at the Central Bank of Morocco as the Director of Economics, Statistics and International Relations. Prior to this, he served as an economist at the World Bank. He holds scientific and advisory positions in various institutions, including the Malabo-Montpellier Panel, the Moroccan Capital Market Authority, and the French Institute of International Relations. He is also advisor to the CEO and Chairman of the OCP Group and serves as a board member of the OCP Foundation and as a global member of the Trilateral Commission. He holds a PhD in Economics from the University of Bordeaux.

Oumayma Bourhriba

Oumayma Bourhriba is a Research Assistant in Economics at the Policy Center for the New South. Her research areas cover macroeconomics, international trade issues and long-term economic growth. Oumayma holds a master’s degree in applied economics and is currently a PhD student at Mohammed V University in Rabat. She joined the Policy Center for the New South in September 2019.

Other articles

Foreword

Alessandro Minuto-Rizzo

Political Summary

Alessandro Politi

Policy Paper

Arab rising and beyond

Claire Spencer

The economy and the civil society

Possible roots of the rising

Abdulaziz Sager

What kind of economic prospects for the region?

Karim El Aynaoui, Oumayma Bourhriba

From the web to the square

Mahboub E. Hasem

Power and identity

10 Years After the Arab Spring: llicit Economies Evolve, Epand and Entrench

Matt Herbert

Libya: a multi-layer conflict

Umberto Profazio

The Egyptian long pacification

Eman Ragab

A new wave of unrest: towards change?

Future perspectives in the Gulf

Jean-Loup Saman

The way ahead

A look the the future

Ahmad Masa’deh

The Alliance looks South

Appendix

The Arab rising by country

Mahboub E. Hashem